Weekly Pulse

Global Eco Pulse shows the impact of uncerntainty

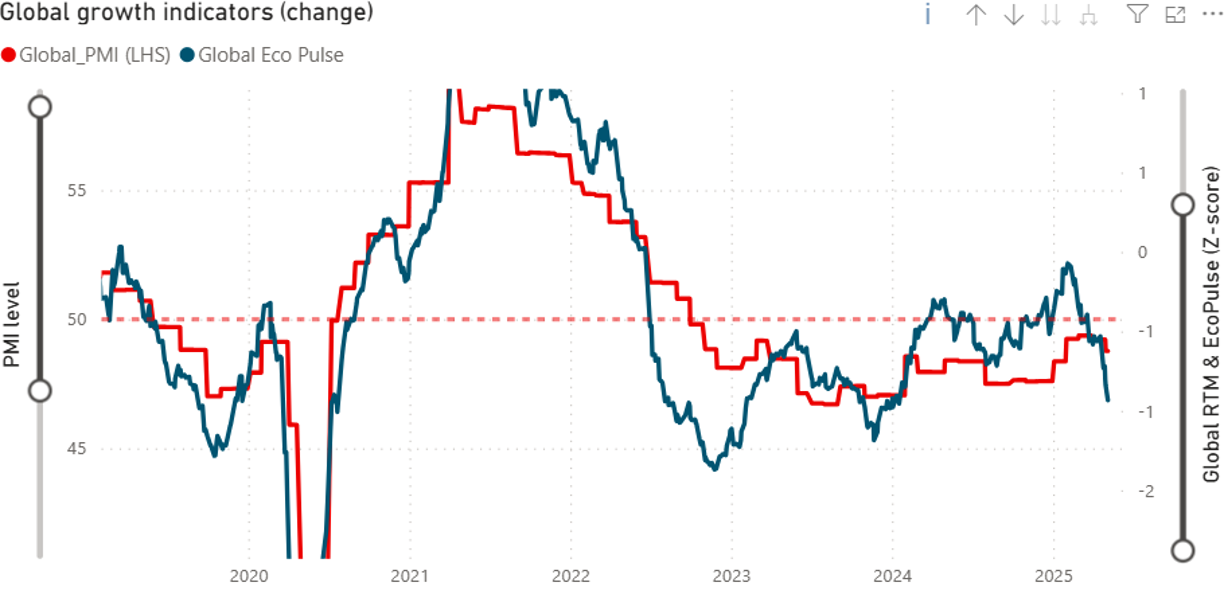

Over recent weeks, one of our proprietary nowcasting tool — the Global Eco Pulse — has diverged meaningfully from traditional survey-based indicators such as the Global PMI. While PMIs remain a widely followed gauge of business sentiment, they are limited by their monthly frequency and slower responsiveness to real-time developments. In contrast, the Eco Pulse is built on high-frequency survey data capturing shifts in economic sentiment, offering a more forward-looking signal on global economic momentum than traditional hard data, which tends to reflect changes with a lag.

As shown in the chart below, the Global Eco Pulse (red line, right-hand scale) has recently moved below the Global PMI (blue line, left-hand scale), having previously signaled a more constructive outlook throughout much of 2024. That relative outperformance proved correct at the time, as global activity was firm in early 2024, despite the lackluster PMI level. While the Global PMI (blue line, left-hand axis) remains near the neutral 50 mark — implying neither expansion nor contraction — the Eco Pulse (red line, right-hand axis) has rolled over sharply, reaching its most negative reading since the height of the 2022 slowdown. The current shift — with the Eco Pulse not only softening more visibly but also having reversed from a level well above the PMI to now below it— reflects a faster and more granular read of emerging macro headwinds, and reinforces the importance of tracking dynamic shifts in leading indicators.

This evolving backdrop coincides with renewed policy uncertainty in the U.S., where recent tariff announcements and a more protectionist tone from the administration have introduced downside risks to global trade and sentiment. Tariffs function much like a negative fiscal impulse, dampening demand while disrupting global supply chains. More broadly, heightened policy unpredictability weighs on financial conditions and corporate decision-making worldwide. While some hard data—such as industrial production or employment—has yet to reflect these shifts, we see this more as a timing lag than a contradiction, with broader effects likely to surface in the coming weeks or months unless tariff rhetoric and implementation de-escalate meaningfully. Our close monitoring of both high-frequency and traditional indicators continues to inform our strategy in a prudent and forward-looking manner.

Get the complete insights

Discover our latest Economic Pulse

Important legal Information

This report has been prepared by Santander Asset Management (hereinafter “SAM”). SAM is the functional name of the asset management business conducted by the legal entity SAM Investment Holdings S.L. and its branches, subsidiaries and representative offices. This document contains economic forecasts and information gathered from several sources. The information contained in this document may have also been gathered from third parties. All these sources are believed to be reliable, although the accuracy, completeness or update of this information is not guaranteed, either implicitly or explicitly, and is subject to change without notice. Any opinions included in this document may not be considered as irrefutable and could differ or be, in any way, inconsistent or contrary to opinions expressed, either verbally or in writing, advices, or investment decisions taken by other areas of SAM. This report is not intended to be and should not be construed in relation to a specific investment objective. This report is published solely for informational purposes. This report does not constitute an investment advice, an offer or solicitation to purchase or sell assets, services, financial contracts or other type of contracts, or other investment products of any type (collectively, the “Financial Assets”), and should not be relied upon as the sole basis for evaluating or assessing Financial Assets. Likewise, the distribution of this report to a client, or to a third party, should not be regarded as a provision or an offer of investment advisory services. SAM makes no warranty in connection with any market forecasts or opinions, or with the Financial Assets mentioned in this report, including with regard to their current or future performance. The past or present performance of any markets or Financial Assets may not be an indicator of such markets or Financial Assets future performance. The Financial Assets described in this report may not be eligible for sale or distribution in certain jurisdictions or to certain categories or types of investors. Except as otherwise expressly provided for in the legal documents of a specific Financial Assets, the Investment Products are not, and will not be, insured or guaranteed by any governmental entity, including the Federal Deposit Insurance Corporation. They are not an obligation of, or guaranteed by, Santander, and may be subject to investment risks including, but not limited to, market and currency exchange risks, credit risk, issuer and counterparty risk, liquidity risk, and possible loss of the principal invested. In connection with the Financial Advisors, investors are recommended to consult their financial, legal, tax and other advisers as such investors deem necessary to determine whether the Financial Assets are suitable based on such investors particular circumstances and financial situation. Santander, their respective directors, officers, attorneys, employees or agents assume no liability of any type for any loss or damage relating to or arising out of the use or reliance of all or any part of this report. Past performance does not predict future returns. The returns may increase or decrease as a result of currency fluctuations relative to the respective investors’ domestic currency. Any reference to taxation should be understood as depending on the personal circumstances of each investor and which may change in the future. Costs incurred for purchasing, holding or selling Financial Assets may reduce returns and are not reflected in this report. This report may not be reproduced in whole or in part, or further distributed, published or referred to in any manner whatsoever to any person, nor may the information or opinions contained therein be referred to without, in each case, the prior written consent of SAM. Any third-party material (including logos, and trademarks), whether literary (articles/ studies/ reports, etc. or excerpts thereof) or artistic (photos/graphs/drawings, etc.), included in this report is registered in the name of its respective owner and only reproduced in accordance with honest industry and commercial practices.