Linking Economic Fundamentals to Growth Forecasting for Informed Investment Decision

Overview

This white paper is the first installment of a three-part series that systematically explores our macroeconomic framework. Understanding the current stage of an economic cycle is essential for informed asset allocation, portfolio construction, and risk assessment. To address this need, we introduce a structured macroeconomic framework designed for developed economies, with a particular focus on the U.S. context. By examining the transmission mechanisms from fundamental economic variables—which, ideally, should be exogenous—to broader economic indicators, we provide a systematic method to anticipate macroeconomic trajectories.

Linking Economic Fundamentals to GDP Growth: A Medium-Term Perspective

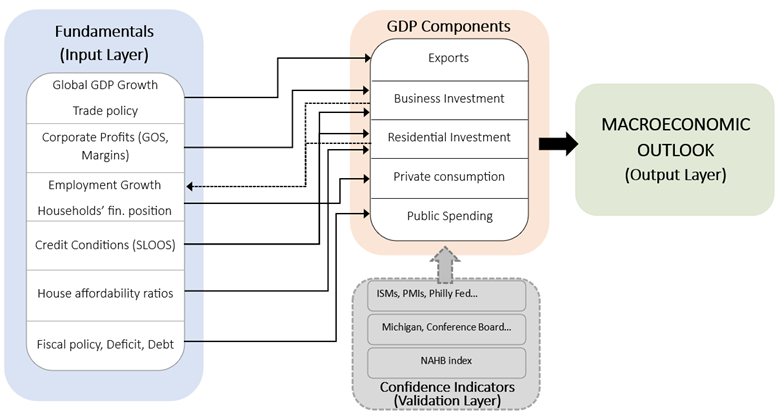

The final goal of our macroeconomic framework is to try to understand in which stage of the cycle the economy is as well as which are the risks that can trigger a change to a new stage. In this regard, our macroeconomic analysis begins by identifying the GDP components that are most critical for assessing the medium-term economic trajectory. While the component's GDP weight is a relevant factor, its correlation with GDP growth emerges as an even more decisive criterion.

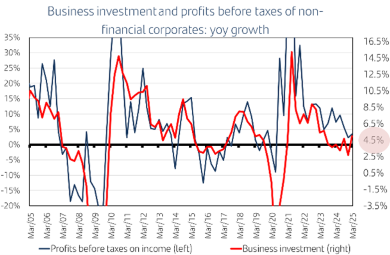

For instance, in the U.S. economy, business investment (which includes both equipment and intellectual property investment) holds considerable importance despite representing less than 10% of GDP. The reason is that, given its direct link to employment, the evolution of business investment is essential for private consumption trend, which is by far, the component with the highest weight on GDP. Conversely, the Eurozone stands out as a region where exports play a more pivotal role—particularly when compared to the U.S. This disparity largely stems from the Eurozone's far greater exposure to the external sector compared to the U.S.

The second step in our analysis involves identifying the specific variables that influence the evolution of each GDP component, not just in the current or next quarter but over the medium term. We refer to these variables as 'fundamentals.'

Since these fundamentals serve as the foundation of our model, they should ideally be exogenous variables, unaffected by the economic cycle. In practice, however, it is challenging to find economic variables that influence the cycle without being influenced by it in return. Acknowledging this difficulty, we strive to select variables that are as exogenous to the cycle as possible.

For instance, in the case of US business investment, we identify as key fundamentals two primary factors: first, credit conditions applied by banks to non-financial companies (in this regard, we closely monitor the Senior Loan Officer Opinion Survey of the Federal Reserve report or SLOOS); and second, variables related to the financial position of non-financial corporations (that reflects the health of their balance sheets) as corporate profits and gross operating surplus.

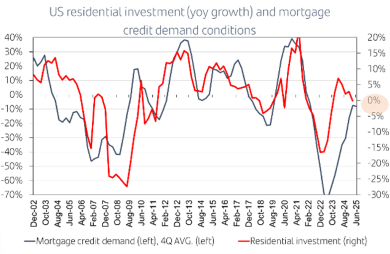

Similarly, when examining another key U.S. GDP component, residential investment, key fundamentals include mortgage credit conditions, credit demand and metrics related to mortgage financing accessibility and housing affordability.

Following the identification of key fundamentals, the third step involves analyzing the current state of each fundamental and, where feasible, projecting their development over the medium term. Subsequently, the fourth step focuses on forecasting the various GDP components (especially, for the medium term), while integrating our perspective on their corresponding fundamentals.

Continuing with the previous example related to the U.S. economy, the current trajectory of non-financial corporate profits suggests a reasonable rise in business investment growth. As to residential investment, the current stance of credit conditions and demand conditions for mortgages according to SLOOS report would suggest that residential investment is not going to accelerate over the next quarters.

The second step in our analysis involves identifying the specific variables that influence the evolution of each GDP component, not just in the current or next quarter but over the medium term. We refer to these variables as 'fundamentals.'

Since these fundamentals serve as the foundation of our model, they should ideally be exogenous variables, unaffected by the economic cycle. In practice, however, it is challenging to find economic variables that influence the cycle without being influenced by it in return. Acknowledging this difficulty, we strive to select variables that are as exogenous to the cycle as possible.

Specifically, when analyzing U.S. business investment, we closely monitor the evolution of business confidence indicators such as ISM, Philadelphia Fed, and PMI. For U.S. residential investment, the most reliable signal appears to be the NAHB indicator. Lastly, in the context of U.S. private consumption, the key references to watch are the Michigan and Conference Board Expectation indexes.

Similarly, when examining another key U.S. GDP component, residential investment, key fundamentals include mortgage credit conditions, credit demand and metrics related to mortgage financing accessibility and housing affordability.

Following the identification of key fundamentals, the third step involves analyzing the current state of each fundamental and, where feasible, projecting their development over the medium term. Subsequently, the fourth step focuses on forecasting the various GDP components (especially, for the medium term), while integrating our perspective on their corresponding fundamentals.

Continuing with the previous example related to the U.S. economy, the current trajectory of non-financial corporate profits suggests a reasonable rise in business investment growth. As to residential investment, the current stance of credit conditions and demand conditions for mortgages according to SLOOS report would suggest that residential investment is not going to accelerate over the next quarters.

Framing the Path Forward

As the first installment of our three-part series, this white paper has laid the groundwork for a comprehensive macroeconomic framework to understanding the stages of the economic cycle, emphasizing the crucial role of identifying GDP components and their underlying fundamentals. The upcoming installments will delve deeper into specific components and their interactions within the economic cycle, providing enhanced clarity on how shifts in fundamentals impact broader macroeconomic trends.

By continually refining our understanding of the economic cycle’s phases, we aim to equip investment professionals with the analytical tools needed to navigate an evolving economic landscape. As we progress through the series, each paper will build on the foundational concepts outlined here, ultimately presenting a cohesive and pragmatic framework for strategic decision-making.

Get the complete insights

Discover our latest articles

Important legal information

This report has been prepared by Santander Asset Management (hereinafter “SAM”). SAM is the functional name of the asset management business conducted by the legal entity SAM Investment Holdings S.L. and its branches, subsidiaries and representative offices. This document contains economic forecasts and information gathered from several sources. The information contained in this document may have also been gathered from third parties. All these sources are believed to be reliable, although the accuracy, completeness or update of this information is not guaranteed, either implicitly or explicitly, and is subject to change without notice. Any opinions included in this document may not be considered as irrefutable and could differ or be, in any way, inconsistent or contrary to opinions expressed, either verbally or in writing, advices, or investment decisions taken by other areas of SAM. This report is not intended to be and should not be construed in relation to a specific investment objective. This report is published solely for informational purposes. This report does not constitute an investment advice, an offer or solicitation to purchase or sell assets, services, financial contracts or other type of contracts, or other investment products of any type (collectively, the “Financial Assets”), and should not be relied upon as the sole basis for evaluating or assessing Financial Assets. Likewise, the distribution of this report to a client, or to a third party, should not be regarded as a provision or an offer of investment advisory services. SAM makes no warranty in connection with any market forecasts or opinions, or with the Financial Assets mentioned in this report, including with regard to their current or future performance. The past or present performance of any markets or Financial Assets may not be an indicator of such markets or Financial Assets future performance. The Financial Assets described in this report may not be eligible for sale or distribution in certain jurisdictions or to certain categories or types of investors. Except as otherwise expressly provided for in the legal documents of a specific Financial Assets, the Investment Products are not, and will not be, insured or guaranteed by any governmental entity, including the Federal Deposit Insurance Corporation. They are not an obligation of, or guaranteed by, Santander, and may be subject to investment risks including, but not limited to, market and currency exchange risks, credit risk, issuer and counterparty risk, liquidity risk, and possible loss of the principal invested. In connection with the Financial Advisors, investors are recommended to consult their financial, legal, tax and other advisers as such investors deem necessary to determine whether the Financial Assets are suitable based on such investors particular circumstances and financial situation. Santander, their respective directors, officers, attorneys, employees or agents assume no liability of any type for any loss or damage relating to or arising out of the use or reliance of all or any part of this report. Past performance does not predict future returns. The returns may increase or decrease as a result of currency fluctuations relative to the respective investors’ domestic currency. Any reference to taxation should be understood as depending on the personal circumstances of each investor and which may change in the future. Costs incurred for purchasing, holding or selling Financial Assets may reduce returns and are not reflected in this report. This report may not be reproduced in whole or in part, or further distributed, published or referred to in any manner whatsoever to any person, nor may the information or opinions contained therein be referred to without, in each case, the prior written consent of SAM. Any third-party material (including logos, and trademarks), whether literary (articles/ studies/ reports, etc. or excerpts thereof) or artistic (photos/graphs/drawings, etc.), included in this report is registered in the name of its respective owner and only reproduced in accordance with honest industry and commercial practices.