Linking Economic Fundamentals to Growth Forecasting for Informed Investment Decision

Overview

This white paper is the first installment of a three-part series that systematically explores our macroeconomic framework. Understanding the current stage of an economic cycle is essential for informed asset allocation, portfolio construction, and risk assessment. To address this need, we introduce a structured macroeconomic framework designed for developed economies, with a particular focus on the U.S. context. By examining the transmission mechanisms from fundamental economic variables—which, ideally, should be exogenous—to broader economic indicators, we provide a systematic method to anticipate macroeconomic trajectories.

Linking Economic Fundamentals to GDP Growth: A Medium-Term Perspective

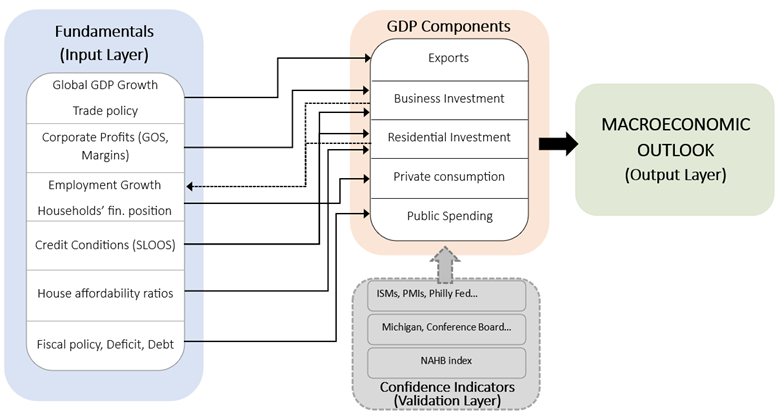

The final goal of our macroeconomic framework is to try to understand in which stage of the cycle the economy is as well as which are the risks that can trigger a change to a new stage. In this regard, our macroeconomic analysis begins by identifying the GDP components that are most critical for assessing the medium-term economic trajectory. While the component's GDP weight is a relevant factor, its correlation with GDP growth emerges as an even more decisive criterion.

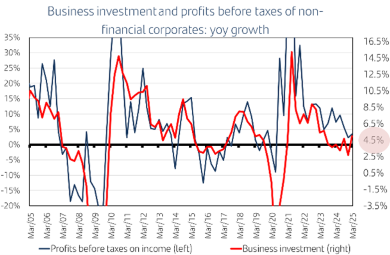

For instance, in the U.S. economy, business investment (which includes both equipment and intellectual property investment) holds considerable importance despite representing less than 10% of GDP. The reason is that, given its direct link to employment, the evolution of business investment is essential for private consumption trend, which is by far, the component with the highest weight on GDP. Conversely, the Eurozone stands out as a region where exports play a more pivotal role—particularly when compared to the U.S. This disparity largely stems from the Eurozone's far greater exposure to the external sector compared to the U.S.

The second step in our analysis involves identifying the specific variables that influence the evolution of each GDP component, not just in the current or next quarter but over the medium term. We refer to these variables as 'fundamentals.'

Since these fundamentals serve as the foundation of our model, they should ideally be exogenous variables, unaffected by the economic cycle. In practice, however, it is challenging to find economic variables that influence the cycle without being influenced by it in return. Acknowledging this difficulty, we strive to select variables that are as exogenous to the cycle as possible.

For instance, in the case of US business investment, we identify as key fundamentals two primary factors: first, credit conditions applied by banks to non-financial companies (in this regard, we closely monitor the Senior Loan Officer Opinion Survey of the Federal Reserve report or SLOOS); and second, variables related to the financial position of non-financial corporations (that reflects the health of their balance sheets) as corporate profits and gross operating surplus.

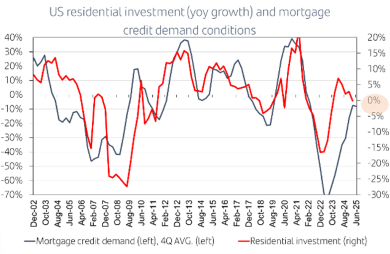

Similarly, when examining another key U.S. GDP component, residential investment, key fundamentals include mortgage credit conditions, credit demand and metrics related to mortgage financing accessibility and housing affordability.

Following the identification of key fundamentals, the third step involves analyzing the current state of each fundamental and, where feasible, projecting their development over the medium term. Subsequently, the fourth step focuses on forecasting the various GDP components (especially, for the medium term), while integrating our perspective on their corresponding fundamentals.

Continuing with the previous example related to the U.S. economy, the current trajectory of non-financial corporate profits suggests a reasonable rise in business investment growth. As to residential investment, the current stance of credit conditions and demand conditions for mortgages according to SLOOS report would suggest that residential investment is not going to accelerate over the next quarters.

The second step in our analysis involves identifying the specific variables that influence the evolution of each GDP component, not just in the current or next quarter but over the medium term. We refer to these variables as 'fundamentals.'

Since these fundamentals serve as the foundation of our model, they should ideally be exogenous variables, unaffected by the economic cycle. In practice, however, it is challenging to find economic variables that influence the cycle without being influenced by it in return. Acknowledging this difficulty, we strive to select variables that are as exogenous to the cycle as possible.

Specifically, when analyzing U.S. business investment, we closely monitor the evolution of business confidence indicators such as ISM, Philadelphia Fed, and PMI. For U.S. residential investment, the most reliable signal appears to be the NAHB indicator. Lastly, in the context of U.S. private consumption, the key references to watch are the Michigan and Conference Board Expectation indexes.

Similarly, when examining another key U.S. GDP component, residential investment, key fundamentals include mortgage credit conditions, credit demand and metrics related to mortgage financing accessibility and housing affordability.

Following the identification of key fundamentals, the third step involves analyzing the current state of each fundamental and, where feasible, projecting their development over the medium term. Subsequently, the fourth step focuses on forecasting the various GDP components (especially, for the medium term), while integrating our perspective on their corresponding fundamentals.

Continuing with the previous example related to the U.S. economy, the current trajectory of non-financial corporate profits suggests a reasonable rise in business investment growth. As to residential investment, the current stance of credit conditions and demand conditions for mortgages according to SLOOS report would suggest that residential investment is not going to accelerate over the next quarters.

Framing the Path Forward

As the first installment of our three-part series, this white paper has laid the groundwork for a comprehensive macroeconomic framework to understanding the stages of the economic cycle, emphasizing the crucial role of identifying GDP components and their underlying fundamentals. The upcoming installments will delve deeper into specific components and their interactions within the economic cycle, providing enhanced clarity on how shifts in fundamentals impact broader macroeconomic trends.

By continually refining our understanding of the economic cycle’s phases, we aim to equip investment professionals with the analytical tools needed to navigate an evolving economic landscape. As we progress through the series, each paper will build on the foundational concepts outlined here, ultimately presenting a cohesive and pragmatic framework for strategic decision-making.

Get the complete insights

Discover our latest articles

Este informe ha sido elaborado por Santander Asset Management (en adelante, “SAM”). SAM es el nombre funcional del negocio de gestión de activos realizado por la entidad jurídica SAM Investment Holdings S.L. y sus sucursales, filiales y oficinas de representación. El presente documento contiene previsiones económicas e información obtenida de varias fuentes. La información contenida en el presente documento puede haber sido recogida también de terceros. Se considera que todas estas fuentes son fiables, aunque la exactitud, integridad o actualización de esta información no está garantizada, ni implícita ni explícitamente, y está sujeta a cambios sin previo aviso. Las opiniones incluidas en este documento no pueden considerarse irrefutables y pueden diferir o ser, de cualquier manera, incoherentes o contrarias a las opiniones expresadas, ya sea verbalmente o por escrito, consejos o decisiones de inversión adoptadas por otras áreas de SAM. El presente informe no ha sido preparado y no debe ser considerado en función de ningún objetivo de inversión. Este documento ha sido realizado con fines exclusivamente informativos, por lo que no constituye una recomendación, asesoramiento personalizado de inversiones, oferta o requerimiento de suscripción o venta de participaciones de cualquier activo o producto de inversión (en adelante “Activos Financieros”), y no debe ser considerado como base única para evaluar o valorar los Activos Financieros. Asimismo, la distribución de este documento a un tercero no constituye una oferta o asesoramiento de inversiones. SAM no garantiza los pronósticos u opiniones expresados en este informe sobre los mercados o los Activos Financieros, incluyendo en relación con su rendimiento actual y futuro. Cualquier referencia a rentabilidades pasadas o presentes no deberá interpretarse como una indicación de los resultados futuros de los mencionados mercados o Activos Financieros. Los Activos Financieros descritos en este informe pueden no ser aptos para su distribución o venta en determinadas jurisdicciones o para ciertas categorías o tipos de inversores. Salvo en los casos en los que así se indique de forma expresa en los documentos legales de un determinado Activos Financieros, éstos no son, y no serán, asegurados ni garantizados por ninguna entidad gubernamental, incluyendo el Federal Deposit Insurance Corporation. No representan una obligación de SAM ni están garantizados por dicha entidad y pueden estar sujetos a riesgos de inversión. Entre los riesgos cabe mencionar, a título enunciativo y no limitativo, riesgos de mercado y de tipos de cambio, de crédito, de emisor y contrapartida, de liquidez y de posibles pérdidas en la inversión principal. Se recomienda a los inversores consultar con sus asesores financieros, legales y fiscales, así como con cualquier otro asesor que consideren necesario a efectos de determinar si los Activos Financieros son apropiados en base a sus circunstancias personales y situación financiera. Santander y sus respectivos consejeros, representantes, abogados, empleados o agentes no asumen ningún tipo de responsabilidad por cualquier pérdida o daño relacionado o que pueda surgir del uso de todo o de parte de este informe. Rentabilidades pasadas no son indicadores de rentabilidades futuras. La rentabilidad puede variar debido a fluctuaciones del tipo de cambio. Cualquier referencia a aspectos fiscales debe ser entendido bajo las circunstancias personales del inversor y está sujeta a variaciones. Los costes derivados de la compra, tenencia o venta de los Activos Financieros pueden reducir su rentabilidad y no se reflejan en este informe. Este informe no puede ser reproducido entera o parcialmente, distribuido, publicado o entregado, bajo ninguna circunstancia, a ninguna persona, ni se debe emitir información u opiniones sobre este informe sin que sea previamente autorizado por escrito, caso por caso, por SAM. Cualquier material de terceros (incluidos logotipos y marcas comerciales) ya sea literal (artículos /estudios / informes / etc. o extractos de los mismos) o artístico (fotos / gráficos / dibujos / etc.) incluido en este informe / publicación está registrado a nombre de sus respectivos propietarios y sólo se reproducen de acuerdo con prácticas leales en materia industrial o comercial.