Market Outlook 2026: Climbing towards new highs

The global economy’s resilience confirms that the cycle is not merely standing its ground, but evolving. Looking ahead to 2026, we anticipate an environment of sustained growth, contained inflation and economic policies that support activity, setting up a favourable framework for investment and diversification. Against this backdrop, we highlight three major investment ideas for the year:

- Global equity: climbing towards new highs beyond the US technology sector, more countries and more sectors are joining in the rally.

- Fixed income: opportunities for policy normalisation in Brazil and the UK, without losing sight of carry in the Eurozone.

- Gold: a natural portfolio diversifier and long-term structural tren.

This year we present our Capital Market Assumptions (CMAs), which are allowing us to incorporate alternative assets in multi-asset portfolios and more efficiently harness the sources of structural returns offered by markets. The CMAs model is proprietary and places conventional assets and private markets in a single analytical framework, aimed at providing a robust and long-term view of expected returns, risk and correlation between asset classes. This framework strengthens the analytical basis for our strategic decisions and builds on our global investment approach.

1. Global Equities: Climbing towards new highs

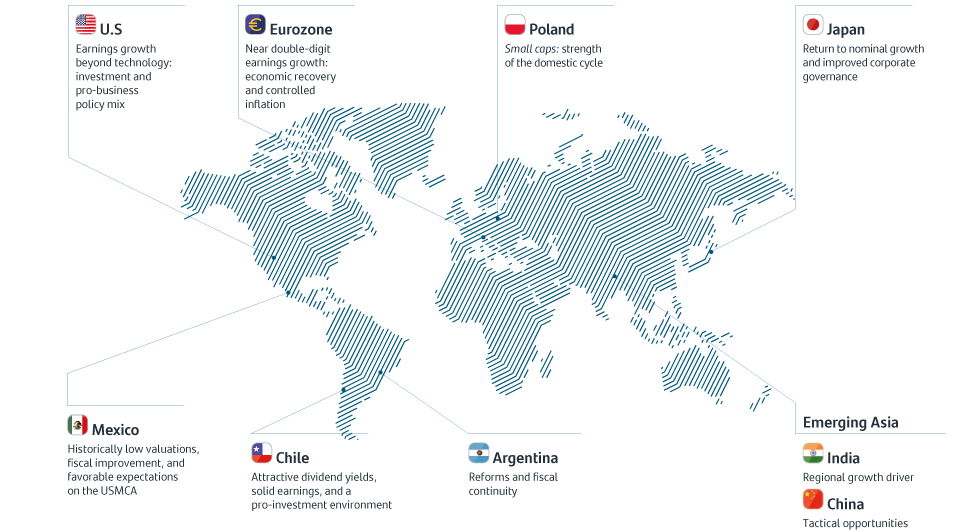

Equities remain at the core of our strategy for 2026. The global backdrop supports this constructive view, which is further reinforced across most major markets when we drill down to the local level. From the broadening of earnings growth in the United States -extending beyond AI-related technology- to near double-digit earnings growth estimates in the Eurozone and the momentum of Latin American markets, equities combine global macro tailwinds and domestic support, consolidating as the main growth engine in diversified portfolios.

While valuations are demanding in some markets, we do not believe this prevents indices from continuing to reach new highs. Periods of economic growth expansion and sustained corporate earnings growth are typically accompanied by higher multiples. In that context, the main historical triggers for turning points in equities have been recessive environments or aggressive rate-hiking cycles -neither of which form part of our central scenario.

2. Fixed income opportunities: Policy normalization with carry in focus

The path toward neutral policy rates progresses at different speeds across geographies. This divergence opens opportunities in UK and Brazilian sovereign bonds, where carry combines with our expectation of rate cuts -potentially deeper than the market is currently pricing. In the Eurozone, strong corporate fundamentals and historically attractive carry make credit a stable source of return for 2026.

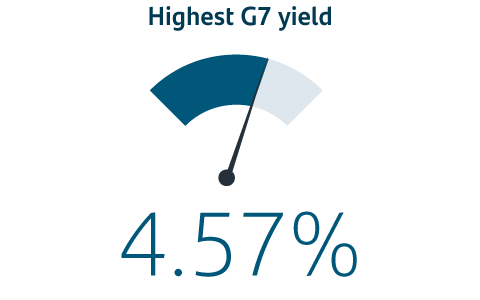

UK

Nominal and inflation-linked UK government bonds still offer the highest yields among G7 economies. Proactive measures to curb inflation, a fiscally disciplined budget with potential further tax increases, and an anticipated gradual decline in Bank of England base rates together provide a supportive backdrop for continued performance.

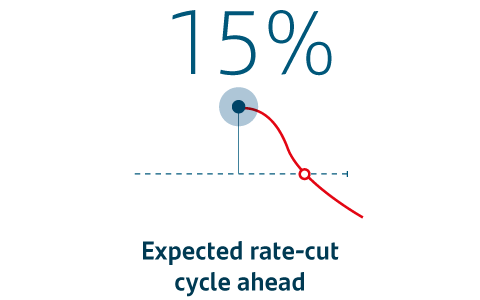

Brazil

The basic Selic rate is at very tight levels, and the combination of moderate economic activity and declining inflation should allow the BCB to start an easing cycle early next year, with potential dovish surprises. The global scenario will also provide support to local fixed income, particularly with the expected cuts in U.S. rates.

Eurozone

We maintain a positive view on Eurozone investment-grade credit for 2026. Yields remain attractive -well above the 10-year and 20-year averages- and offer an additional premium over sovereign debt. Strong demand, particularly from retail investors, and robust corporate balance sheets leave room for further spread tightenings.

Source of all charts: Bloomberg y Santander AM

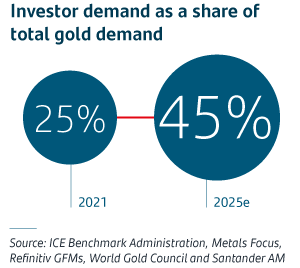

3. Gold: Portfolio diversifier and structural trend

In a context where geopolitical risks persist, inflation has not disappeared, and investors perceive that central banks will continue to prioritize growth over price control, gold remains an effective hedge and a key component for portfolio diversification. Underlying fundamentals also remain solid: the continuation of central bank purchases and renewed investor demand after several years of negative flows.

CMAs for public and private markets

These three key investment ideas reflect the combination of our global and local capabilities and are supported by our proprietary CMAs framework- an approach that allows us to integrate traditional and private markets in a single analytical model. Looking ahead to 2026, we identify European Private Debt as the main investment opportunity within the alternative assets universe.

What will 2026 bring?

Discover our key messages and possible investment strategies to follow.

This report has been prepared by Santander Asset Management (hereinafter “SAM”). SAM is the functional name of the asset management business conducted by the legal entity SAM Investment Holdings S.L. and its branches, subsidiaries and representative offices. This document contains economic forecasts and information gathered from several sources. The information contained in this document may have also been gathered from third parties. All these sources are believed to be reliable, although the accuracy, completeness or update of this information is not guaranteed, either implicitly or explicitly, and is subject to change without notice. Any opinions included in this document may not be considered as irrefutable and could differ or be, in any way, inconsistent or contrary to opinions expressed, either verbally or in writing, advices, or investment decisions taken by other areas of SAM. This report is not intended to be and should not be construed in relation to a specific investment objective. This report is published solely for informational purposes. This report does not constitute an investment advice, an offer or solicitation to purchase or sell assets, services, financial contracts or other type of contracts, or other investment products of any type (collectively, the “Financial Assets”), and should not be relied upon as the sole basis for evaluating or assessing Financial Assets. Likewise, the distribution of this report to a client, or to a third party, should not be regarded as a provision or an offer of investment advisory services. SAM makes no warranty in connection with any market forecasts or opinions, or with the Financial Assets mentioned in this report, including with regard to their current or future performance. The past or present performance of any markets or Financial Assets may not be an indicator of such markets or Financial Assets future performance. The Financial Assets described in this report may not be eligible for sale or distribution in certain jurisdictions or to certain categories or types of investors. Except as otherwise expressly provided for in the legal documents of a specific Financial Assets, the Investment Products are not, and will not be, insured or guaranteed by any governmental entity, including the Federal Deposit Insurance Corporation. They are not an obligation of, or guaranteed by, Santander, and may be subject to investment risks including, but not limited to, market and currency exchange risks, credit risk, issuer and counterparty risk, liquidity risk, and possible loss of the principal invested. In connection with the Financial Advisors, investors are recommended to consult their financial, legal, tax and other advisers as such investors deem necessary to determine whether the Financial Assets are suitable based on such investors particular circumstances and financial situation. Santander, their respective directors, officers, attorneys, employees or agents assume no liability of any type for any loss or damage relating to or arising out of the use or reliance of all or any part of this report. Past performance does not predict future returns. The returns may increase or decrease as a result of currency fluctuations relative to the respective investors’ domestic currency. Any reference to taxation should be understood as depending on the personal circumstances of each investor and which may change in the future. Costs incurred for purchasing, holding or selling Financial Assets may reduce returns and are not reflected in this report. This report may not be reproduced in whole or in part, or further distributed, published or referred to in any manner whatsoever to any person, nor may the information or opinions contained therein be referred to without, in each case, the prior written consent of SAM. Any third-party material (including logos, and trademarks), whether literary (articles/ studies/ reports, etc. or excerpts thereof) or artistic (photos/graphs/drawings, etc.), included in this report is registered in the name of its respective owner and only reproduced in accordance with honest industry and commercial practices.