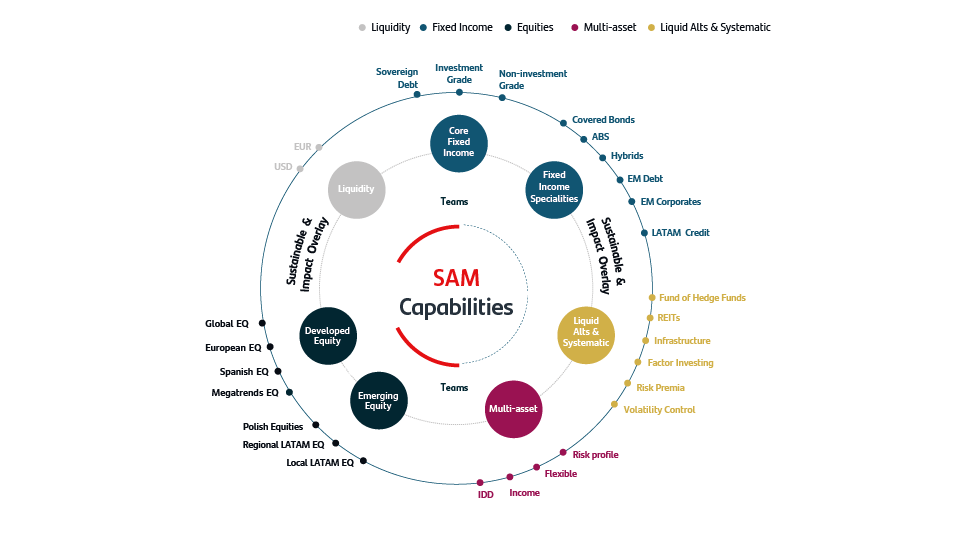

Institutional capabilities

We are an asset manager that combines the best of complementary worlds, technology and expertise, to provide clients access to optimal and innovative solutions while mindful of making a positive impact on both the environment and society.

- Local teams use their in-depth client knowledge to uncover new opportunities that enhance our offering. Our presence in 9 markets in Europe and Latin America provides us with a unique global perspective.

- Listening to our clients is key to understand how their needs evolve. From plain vanilla solutions to sophisticated opportunities, we offer a comprehensive range of investment solutions.

- As much as performance is key, risk control is also a priority. Whether we work with institutional or individual clients, we adhere to a strict risk control process in order to protect and enhance the value of their portfolios.

Investment Capabilities

Our aim is to be the best-in-class investment solution provider in Europe and the Americas by building long-term relationships with our clients. We are a global asset manager with extensive local knowledge in Europe and Latin America, working as a single team in 9 major markets and with +54 years of experience.

Fixed Income: Our process, our experience, our reliability

We offer a complete range of investment solutions including cash management, government & corporate bonds, with a recognized track record in our core markets. We invest across the full range of maturities, instruments and credits available, thanks to our experienced portfolio managers and analysts with strong local expertise.

Our Investment Process is a fundamentally driven approach, based on our research capabilities, a strong global risk and compliance control process.

- Covered Bonds

- Floating Rate Bonds

- Unconstraint /Flexible strategies

- Euro Corporate Bonds

- Short Duration Corporates

- Short Duration LATAM & EM

- LATAM & EM Debt

- LATAM & EM Corporates

- Green Bonds

Equity Strategies: leading performers in our focus markets

Fully integrated team exclusively dedicated to this regional asset class, and our strong presence in local markets allows us to detect opportunities in specific markets’ singularities and dynamics. All this is achieved through a consistent and disciplined approach, based on proprietary fundamental research for stock selection, anchored on valuation parameters that maximize returns to shareholders. In addition, risk management and capital preservation are deeply rooted in our philosophy, which, together with proprietary style, allows us to take advantage of opportunities arising from under-researched companies.

Highly recognized boutique in our core markets with strong expertise in Small and Mid-cap, Income strategies, and Thematic investment. Together with proprietary style, it allows us to take advantage of opportunities arising from under- researched companies.

Alternative Investments

Santander Alternative Investments, part of Santander Asset Management, has an excellent team of specialists, with more than 15 years of experience in the sectors they manage, aim to forge trusting relationships and create a unique and distinctive experience.

It offers access to a range of alternative investment opportunities in Private Debt, Infrastructure & Energy, Real Estate and Funds of Funds, leveraging our strengths and our extensive origination capabilities. More information in Santander Alternative Investments>