Local asset classes

We offer a complete range of investment solutions including cash management, inflation linkers and government & corporate bonds, with a recognized track record in our core markets. We invest across the full range of maturities, instruments and credits available, thanks to our experienced portfolio managers and analysts with strong local expertise.

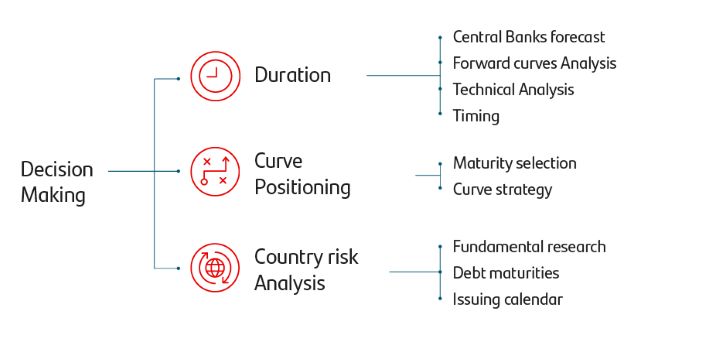

Our Investment Process is a fundamentally driven approach, based on our research capabilities and a strong global risk and compliance control process. Our investment process is a four-step approach: starting with a top-down analysis and considering the macroeconomic scenario, we then focus on our fundamental in-house credit research team views, and results on our proprietary recommendation list. Final step consists on enhanced risk monitoring and portfolio tracking analysis.

We operate through a common European hub and specific country hubs in Latin America, given each country’s uniqueness.

Fixed Income

Equity

In terms of local equity, we are a highly recognized boutique in our core markets, with 80% of our local funds placed in 1st & 2nd quartiles. Clear leaders in Small and Mid-cap strategies, we also cover a diversified range of active strategies including including ESG, income strategies, thematic investment, etc,…

Our investment process is based on a top-down and a bottom-up approach. We apply a top-down macroeconomic analysis that provides us with valuable input for supporting our stock selection process and deciding in which sectors and countries we want to be over or underweight, versus the benchmark. We rely on our proprietary valuation models, updated regularly.