Investment and Consumption Fundamentals: Cornerstones of the Macroeconomic Framework

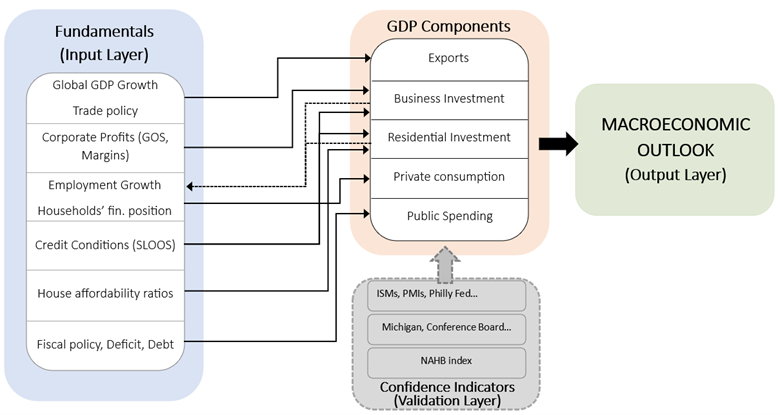

In the first installment of our three-part series, we emphasized the crucial role of identifying the key fundamentals underpinning the various components of GDP. These fundamentals form the backbone of our macroeconomic framework.

In this second installment, we turn our attention to those key drivers across four critical components: business investment, residential investment, structures investment, and private consumption. The first three are particularly important in shaping employment growth, which, in turn, is the primary determinant of private consumption. This latter component represents the largest share of GDP across Developed Economies—especially in the United States.

While business investment may carry less absolute weight in the economy, it holds the strongest correlation with GDP growth. Its volatility tends to anticipate cyclical turning points, reflecting its deep linkage to employment trends. For this reason, especially in the U.S., our analytical process often begins with a detailed assessment of the medium-term fundamentals shaping business investment.

These fundamentals fall broadly into two interconnected categories: credit conditions for non-financial corporates and the financial position of those firms. On the credit front, we closely monitor the Senior Loan Officer Opinion Survey (SLOOS), paying particular attention to standard lending criteria and credit demand. On the financial health side, our focus includes metrics such as corporate and non-corporate profits, gross operating surplus (GOS), and the so-called financing gap—defined as the difference between capital expenditures and internally generated funds, indicating whether firms are net borrowers or savers.

To look forward, we go beyond current readings and assess the potential trajectory of these variables. For instance, GOS can be deconstructed into Gross Value Added (GVA), employee compensation, interest payments, and tax payments. To estimate the margin between GVA and labor costs, we use profit margins as a proxy. Specifically, we define margins as the spread between output prices (CPI inflation) and input costs—particularly unit labor costs (ULC), which capture the gap between wage growth and productivity. Compression in these margins—whether driven by falling CPI or rising ULC—often signals an upcoming decline in GOS and, by extension, in capital expenditures.

For the remaining components of GOS, we examine the trajectory of medium-term yields and central bank policy rates to forecast interest payments, while current tax policy gives us insight into potential shifts in tax payments. Disaggregating these dynamics enables a more granular view of corporate financial resilience and investment prospects.

Compared to business investment, residential investment plays a smaller role in shaping GDP outcomes. Its correlation with GDP is lower, and it tends to react to, rather than lead, broader macroeconomic trends. Still, we view it as a meaningful indicator of cyclical momentum.

Here, too, we rely on SLOOS—particularly indicators related to mortgage credit standards and demand—as well as on measures of housing affordability and mortgage accessibility. These fundamentals provide insight into near-term risks or supports to residential investment.

The third investment category, structures, also carries limited influence over GDP dynamics. Nonetheless, we track it through key drivers such as commercial real estate lending standards (SLOOS) and public policy initiatives like the Inflation Reduction Act (IRA) and the CHIPS Act. These fiscal measures have directed significant investment into targeted sectors via subsidies, tax credits, and direct expenditure.

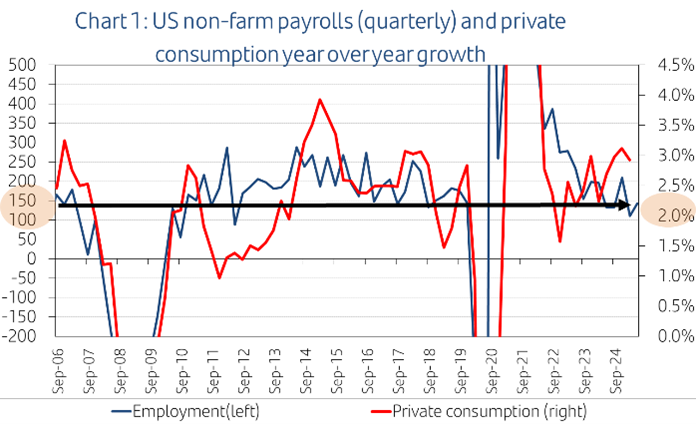

Having covered the three investment components, we now pivot to their key transmission channel—employment. Employment acts as the crucial bridge between capital spending and private consumption. Indeed, among all consumption drivers, employment is paramount (chart 1).

Among labor market indicators, we consider non-farm payrolls growth to be the most telling metric for capturing the direct link between investment and private consumption—far more so than indicators like the unemployment rate. However, it’s important to recognize that not all employment sectors are equally sensitive to capital spending dynamics.

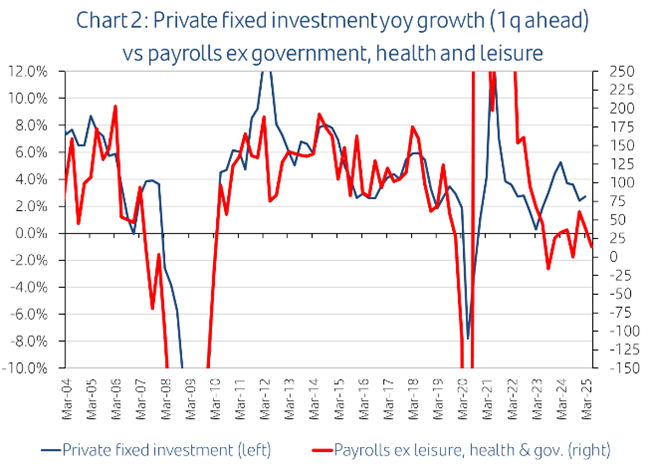

In contrast, employment in sectors such as government and healthcare—and to a lesser extent, leisure—tends to grow steadily over time, largely independent of fluctuations in investment. These patterns have diverged further in recent years, especially following the COVID-19 outbreak, which altered the monthly pace of job gains in these areas.

This distinct trajectory matters. While these sectors are not tightly coupled with investment, they nonetheless exert a meaningful influence on private consumption due to their substantial contribution to total employment—over 30%. Recognizing this divergence is crucial to accurately interpreting labor market trends within the broader macroeconomic framework (chart 2).

Beyond employment, we highlight two additional variables shaping private consumption: consumer credit conditions and household financial health. Again, SLOOS provides insight into the former—specifically bank willingness to extend consumer loans and credit card availability. For the latter, we assess household saving rates in historical context, net lending/borrowing positions, and balance-sheet-derived net wealth.

With this review, we have outlined the key macroeconomic fundamentals that govern investment and consumption—forming the core pillars of our analytical macroeconomic framework. In the third and final installment of this series, we will conclude our framework by addressing the remaining GDP components: government expenditure and the external sector. We will then integrate all elements into a unified structure for tracking and forecasting economic cycles.

Discover our latest articles

Este informe ha sido elaborado por Santander Asset Management (en adelante, “SAM”). SAM es el nombre funcional del negocio de gestión de activos realizado por la entidad jurídica SAM Investment Holdings S.L. y sus sucursales, filiales y oficinas de representación. El presente documento contiene previsiones económicas e información obtenida de varias fuentes. La información contenida en el presente documento puede haber sido recogida también de terceros. Se considera que todas estas fuentes son fiables, aunque la exactitud, integridad o actualización de esta información no está garantizada, ni implícita ni explícitamente, y está sujeta a cambios sin previo aviso. Las opiniones incluidas en este documento no pueden considerarse irrefutables y pueden diferir o ser, de cualquier manera, incoherentes o contrarias a las opiniones expresadas, ya sea verbalmente o por escrito, consejos o decisiones de inversión adoptadas por otras áreas de SAM. El presente informe no ha sido preparado y no debe ser considerado en función de ningún objetivo de inversión. Este documento ha sido realizado con fines exclusivamente informativos, por lo que no constituye una recomendación, asesoramiento personalizado de inversiones, oferta o requerimiento de suscripción o venta de participaciones de cualquier activo o producto de inversión (en adelante “Activos Financieros”), y no debe ser considerado como base única para evaluar o valorar los Activos Financieros. Asimismo, la distribución de este documento a un tercero no constituye una oferta o asesoramiento de inversiones. SAM no garantiza los pronósticos u opiniones expresados en este informe sobre los mercados o los Activos Financieros, incluyendo en relación con su rendimiento actual y futuro. Cualquier referencia a rentabilidades pasadas o presentes no deberá interpretarse como una indicación de los resultados futuros de los mencionados mercados o Activos Financieros. Los Activos Financieros descritos en este informe pueden no ser aptos para su distribución o venta en determinadas jurisdicciones o para ciertas categorías o tipos de inversores. Salvo en los casos en los que así se indique de forma expresa en los documentos legales de un determinado Activos Financieros, éstos no son, y no serán, asegurados ni garantizados por ninguna entidad gubernamental, incluyendo el Federal Deposit Insurance Corporation. No representan una obligación de SAM ni están garantizados por dicha entidad y pueden estar sujetos a riesgos de inversión. Entre los riesgos cabe mencionar, a título enunciativo y no limitativo, riesgos de mercado y de tipos de cambio, de crédito, de emisor y contrapartida, de liquidez y de posibles pérdidas en la inversión principal. Se recomienda a los inversores consultar con sus asesores financieros, legales y fiscales, así como con cualquier otro asesor que consideren necesario a efectos de determinar si los Activos Financieros son apropiados en base a sus circunstancias personales y situación financiera. Santander y sus respectivos consejeros, representantes, abogados, empleados o agentes no asumen ningún tipo de responsabilidad por cualquier pérdida o daño relacionado o que pueda surgir del uso de todo o de parte de este informe. Rentabilidades pasadas no son indicadores de rentabilidades futuras. La rentabilidad puede variar debido a fluctuaciones del tipo de cambio. Cualquier referencia a aspectos fiscales debe ser entendido bajo las circunstancias personales del inversor y está sujeta a variaciones. Los costes derivados de la compra, tenencia o venta de los Activos Financieros pueden reducir su rentabilidad y no se reflejan en este informe. Este informe no puede ser reproducido entera o parcialmente, distribuido, publicado o entregado, bajo ninguna circunstancia, a ninguna persona, ni se debe emitir información u opiniones sobre este informe sin que sea previamente autorizado por escrito, caso por caso, por SAM. Cualquier material de terceros (incluidos logotipos y marcas comerciales) ya sea literal (artículos /estudios / informes / etc. o extractos de los mismos) o artístico (fotos / gráficos / dibujos / etc.) incluido en este informe / publicación está registrado a nombre de sus respectivos propietarios y sólo se reproducen de acuerdo con prácticas leales en materia industrial o comercial.